e-Kyc

e-Kyce-Kyc

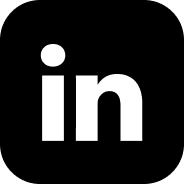

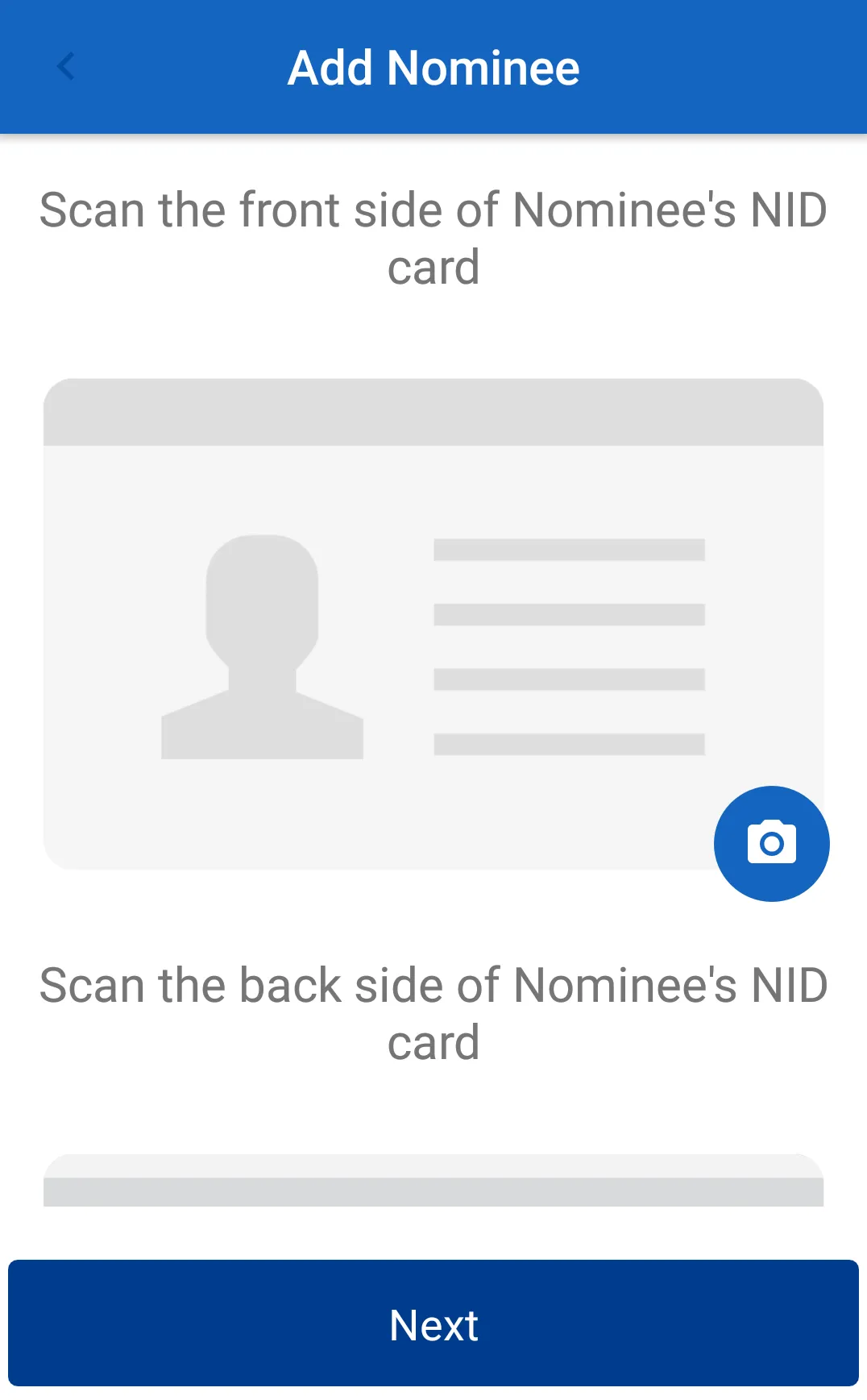

e-KYC (Electronic Know your Client) can provide an ample scope of quick onboarding of customer by verifying customer identity through digital means which can leverage saving of time and provide ease both for the client and service providers. Additionally, e-KYC can save institutional cost as well as foster growth of customer base compare to the traditional growth.

Features

- Establish good governance within the financial industry.

- Enhancing the growth of financial inclusion.

- Protect financial sector from abuse of criminal activities

- Ensure integrity and stability of the financial sector.

- Manage ML/TF risks

- Reduction of cost related to customer on boarding and managing CDD.

- Promote fintech services.

- Participate in the national level well-being

Benifits

- Completely automated and instantaneous

- Reduced failed client acquisition and acquiring new customers

- Reduce fraud

- Improve customer experience

- Faster and more flexible access to banking services

- Perceived as an innovative and open-minded bank

- Reduce paper usage and document loss

- Improved operational effectiveness.

Canada Office

1161 Skylark Ave, Oshawa, ON, Canada, L1K 1G8

@sigmasolutionscanada.ca

+1647 613 4347

Bangladesh Office

Abedin tower (Level 5), 35 Kemal Ataturk Avenue, Banani C/A, Dhaka 1213

@sigmasolutions.com.bd

+88 01817 181215

Subscribe to know more

© Sigma Solutions - 2023 All Rights Reserved